Fund the development of a portfolio of photovoltaic projects under development in Italy.

The Sunrise Italia project, developed by the Sun Investment Group, aims to finance the development of a portfolio of photovoltaic projects located in Italy, with a total capacity of 113 MW.

This portfolio is part of the energy transition dynamics and contributes to the deployment of renewable energy across the Italian territory.

The Sun Investment Group is looking to raise a second tranche of €700,000, as part of a global fundraising target of €4,100,000.

Among the 12 projects in this portfolio, 7 already have a grid connection agreement, totaling 66 MW. The rest of the portfolio is in the early stages of development and will be subject to further funding rounds, pending Enerfip’s approval.

The offer

Fund the development of 113 MW of solar in Italy

The company Sun Investment Group offers an investment opportunity in the context of financing the Sunrise Italia T2 project.

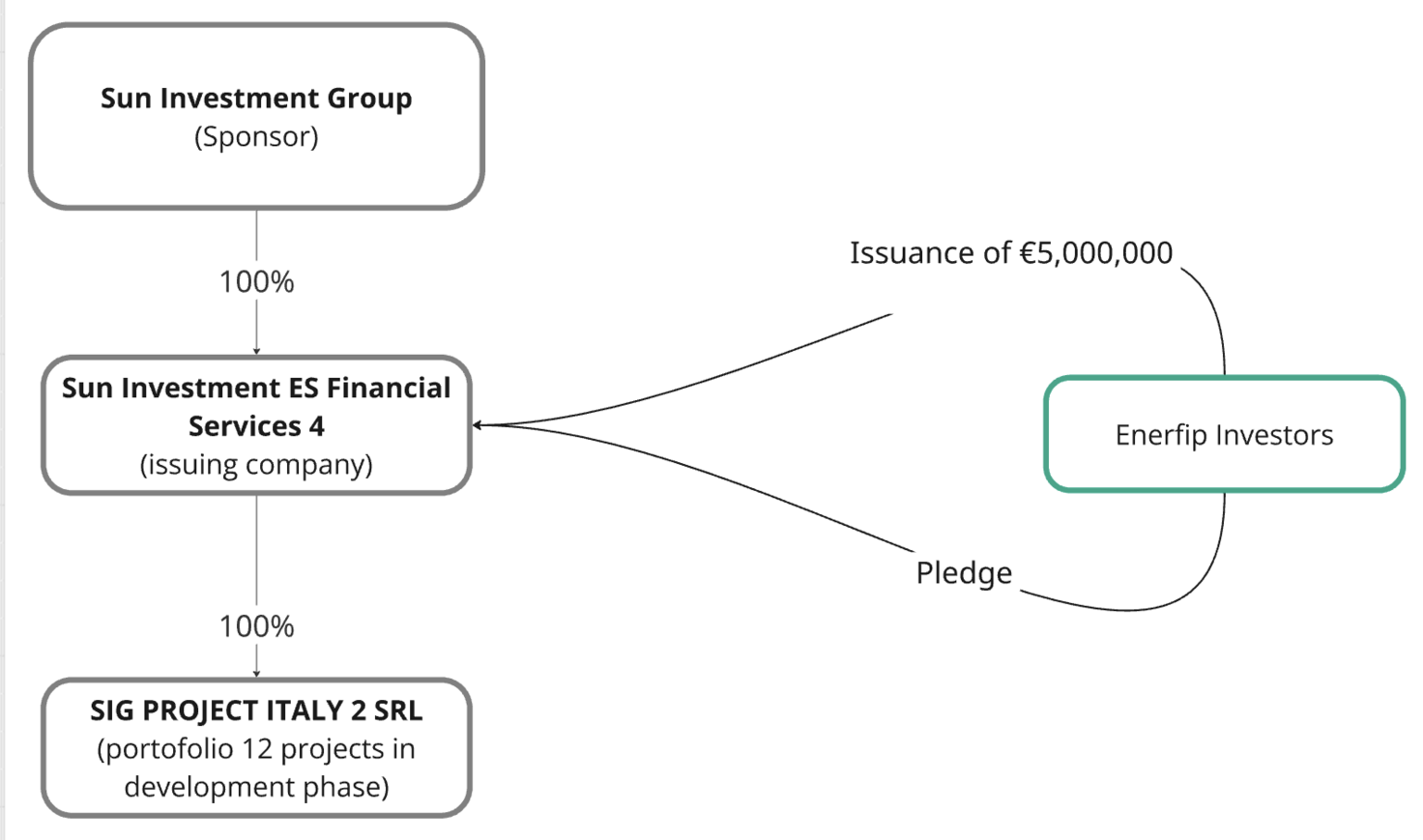

The issuance is structured through a Spanish issuing company, Sun Investment ES Financial Services 4, as the financial team of Sun Investment Group is based in Spain. This company is 100% shareholder of SIG PROJECT ITALY 2 SRL, which holds the project portfolio.

This second tranche, made in the form of senior debt, aims to raise up to €700,000 as part of a second crowdfunding financing round.

Successive funding tranches may be launched, subject to Enerfip’s approval. The securing of grid access and land for the remainder of the portfolio will be assessed by our teams and will be a prerequisite for unlocking a subsequent tranche.

The repayment of the bonds may occur progressively as the projects reach their key development milestones and are sold to third parties. Refinancing operations may also be implemented depending on the progress of the projects:

- Through a bank loan at a more favorable interest rate;

- Via new funding through Enerfip;

- Through an equity contribution from SIG.

The funds raised will finance several key areas related to the development of the projects:

- Environmental and urban studies;

- Submission and processing of building permits;

- Deposits for grid connections;

- Other investment expenses related to the development phase.

In terms of guarantees, investors benefit from:

- Pledge of 100% of the Issuer’s shares;

- Subordinated corporate guarantee from SIG Italy 2.

Specifications

Investment phases

- Investment open to everyone

End of project financing

Resources

Simulator

Investment simulation

Sunrise Italia T2 - Obligation 9.5%/year over 3 years

Simulation - Rate : 9.5% / year on 3 ans

Initial investment:

€1,000

Repayments and interest:

€1,285

In 3 transfers

| Date | Interest* | Capital | Amount |

| 19/12/2026 | €95 | €0 | €95 |

| 19/12/2027 | €95 | €0 | €95 |

| 19/12/2028 | €95 | €1,000 | €1,095 |

| Total | €285 | €1,000 | €1,285 |

*Gross interest before tax, including all fees (view taxation) The dates are indicative. The final dates will be available once the project is officially closed. The result presented is not a forecast of the future performance of your investments. It is only intended to illustrate the mechanics of your investment over the investment period. The evolution of the value of your investment may vary from what is shown, either increasing or decreasing. | |||

The project

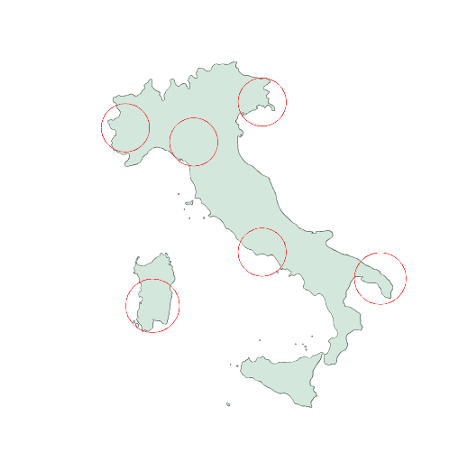

The Sunrise Italia T2 project, developed by the Sun Investment Group, consists of a portfolio of 12 ground-mounted photovoltaic projects, located in several regions of Italy, with a total capacity of 113 MWc.

These projects are developed by the company SIG PROJECT ITALY 2 SRL, 100% owned by Sun Investment ES Financial Services 4 SA, which is also the issuer of the bonds as part of this crowdfunding operation.

Project Locations

Overall Progress Status

Grid Connection:

- 7 projects already have a grid connection agreement

- 4 projects have already submitted a connection request

- 1 project has not yet submitted a connection request

Land: 12 projects have signed land lease agreements

Administrative Permits:

- 3 projects have already started the procedure

- 9 projects are in the preparatory phase

Portfolio Summary

| Total number of projects | Technology | Total Capacity |

|---|---|---|

| 12 | Ground-mounted PV | 113 MWc |

Project owners

A leading European solar player in full expansion

Sun Investment Group (SIG), headquartered in Lithuania, is one of Europe’s leading developers of solar photovoltaic projects. Active in 4 countries including Italy, Poland, and Spain, the group controls the entire value chain—from project development to construction, operation, and maintenance. Initially focused on selling its assets once operational, SIG is now shifting towards an Independent Power Producer (IPP) model, retaining its plants to generate steady revenues through electricity sales. This strategic transition involves significant capital investment and greater diversification in funding sources, including opening up to crowdfunding. With over 2.7 GWp in development and more than 200 MWp already operational, SIG is well on its way to becoming a key player in the European renewable energy market.

SUN INVESTMENT GROUP

Sun Investment Group (SIG) is one of the leading solar photovoltaic energy development groups in Europe.

Headquartered in Lithuania, the group currently operates in 4 countries, including Italy, Poland, and Spain, as an Independent Power Producer (IPP) and EPC contractor (Engineering, Procurement, and Construction).

SIG covers the entire solar PV value chain: from development to construction, including operations and maintenance, with the ability to optimize costs and generate value at each stage of the asset lifecycle.

The group’s financing strategy is mainly based on private loans raised from investment funds. This is the first time SIG has used crowdfunding to finance project development.

Previously focused on selling developed/built assets once they reached the “ready-to-build” or operational phase, the group is now shifting to an IPP (“Independent Power Producer”) business model. Assets will be retained to generate regular cash flows from electricity sales. This model requires significant capital expenditures.

Founded in 2017, the group has over 2.7 GWp under development and already operates more than 200 MWp. According to the company, SIG’s asset portfolio is valued at over €80 million.

Our analysis

Risk overview

Construction risks

Risk that the connection to the distribution or transmission network has not been completed or is not approved by the relevant authority before the planned date of commercial operation.

Mitigation methods

Los equipos de SIG cuentan con un sólido conocimiento técnico y una amplia experiencia en el desarrollo de proyectos fotovoltaicos en Italia. Además, la cartera de proyectos presentada se encuentra en una fase temprana de desarrollo, con algunos proyectos que aún no han obtenido los permisos de conexión. Estos proyectos formarán parte de una segunda ronda de financiación (sujeta a la aprobación de Enerfip). En caso de que el desarrollo de alguno de estos proyectos fracase, el promotor se compromete a sustituirlo por un proyecto similar, en tamaño y en fase de desarrollo, con el fin de mantener el ratio LTV.

Counterparty risk

Risk of counterparty payment default that would jeopardize the project's cash inflows

Mitigation methods

Se contemplan varias vías de reembolso: ya sea mediante la venta de algunos proyectos a medida que se superan las etapas de desarrollo, o mediante aportaciones de capital por parte de SIG. También podrán llevarse a cabo operaciones de refinanciación, ya sea a través de un préstamo bancario con un tipo de interés más ventajoso, o mediante una refinanciación mediante emisiones de bonos a través de Enerfip. En caso de incumplimiento, Enerfip podrá ejecutar la garantía constituida en el marco de esta financiación, es decir, la prenda de las participaciones de la sociedad española que posee los proyectos italianos.

Country risk

Risk of policy change

Mitigation methods

Italia es un país políticamente estable. Sin embargo, el principal desafío sigue siendo el riesgo climático, que el país intenta mitigar mediante infraestructuras adecuadas y el fortalecimiento de las normas medioambientales frente a los desastres naturales.

Development risk

Risk relating to authorizations issued to the company and land, and third-party appeals against authorizations issued.

Mitigation methods

Los equipos de SIG cuentan con un sólido conocimiento técnico y una amplia experiencia en el desarrollo de proyectos fotovoltaicos en Italia. Además, la cartera de proyectos presentada se encuentra en una fase temprana de desarrollo, con algunos proyectos que aún no han obtenido los permisos de conexión. Estos proyectos formarán parte de una segunda ronda de financiación (sujeta a la aprobación de Enerfip). En caso de que el desarrollo de alguno de estos proyectos fracase, el promotor se compromete a sustituirlo por un proyecto similar, en tamaño y en fase de desarrollo, con el fin de mantener el ratio LTV.

Risk of natural disaster

Risk of extreme weather conditions that could impact the profitability of the parks or even destroy them (storms, fires).

Mitigation methods

Italia es un país políticamente estable. Sin embargo, el principal desafío sigue siendo el riesgo climático, que el país intenta mitigar mediante infraestructuras adecuadas y el fortalecimiento de las normas medioambientales frente a los desastres naturales.

Investing in this participatory financing project involves risks, including the risk of total or partial loss of the capital invested. Your investment is not covered by the deposit guarantee schemes established in accordance with directive 2014/49/EU of the European Parliament and of the Council. Your investment is also not covered by the investor compensation schemes established in accordance with Directive 97/9/EC of the European Parliament and of the Council. Return on investment is not guaranteed. This is not a savings product, and we recommend that you not to invest more than 10% of your net assets in participatory finance projects. You may not be able to sell the investment instruments when you wish. If you are able to sell them, however, you may incur losses.